At Northfield Park District, we believe the whole is greater than the sum of our parks. That's because our parks are more than just points on a map—they’re places where people connect, gather, and create lifelong memories.

Together, they form the heartbeat of our thriving community—spaces that make residents feel part of something larger than themselves. When we invest in these shared spaces, we strengthen the very roots of Northfield—today and for generations to come.

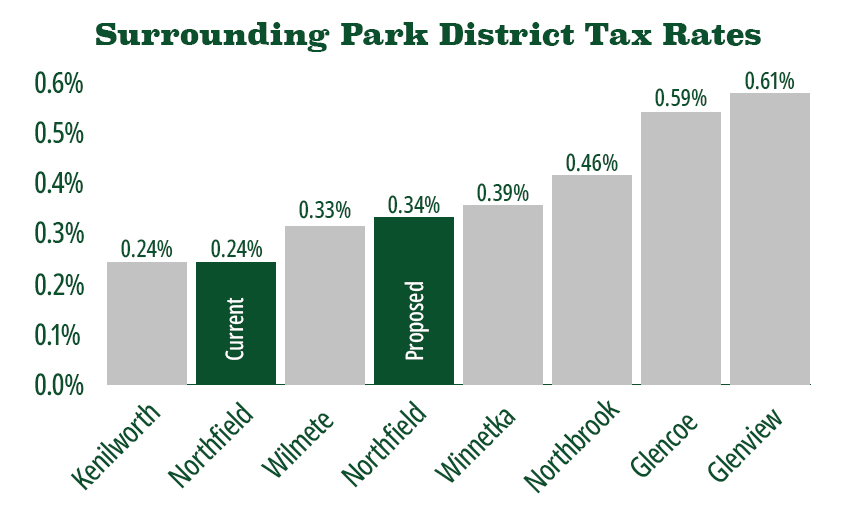

Our parks and programs not only bring people together but also enhance property values and the overall quality of life in Northfield. To support sustainable growth including implementation of the Comprehensive Master Plan, the Park District is placing a referendum on the ballot for the March 2026 election asking voters to approve a 0.1% increase to the limiting rate.

___________________________________________________________________________________________________________________________________________

Key Takeaways

- The Park District has been a trusted steward of taxpayer funds, providing the parks, programs, and facilities we enjoy today while maintaining one of the lowest tax rates in the region.

- The Park District has been financially responsible since its inception. A property tax referendum is the next financially responsible step to fund Park District growth as well as the continued operation of the highest quality parks, facilities and programs for years to come.

- The Park District is using the community driven Comprehensive Master Plan as a road map for the future.

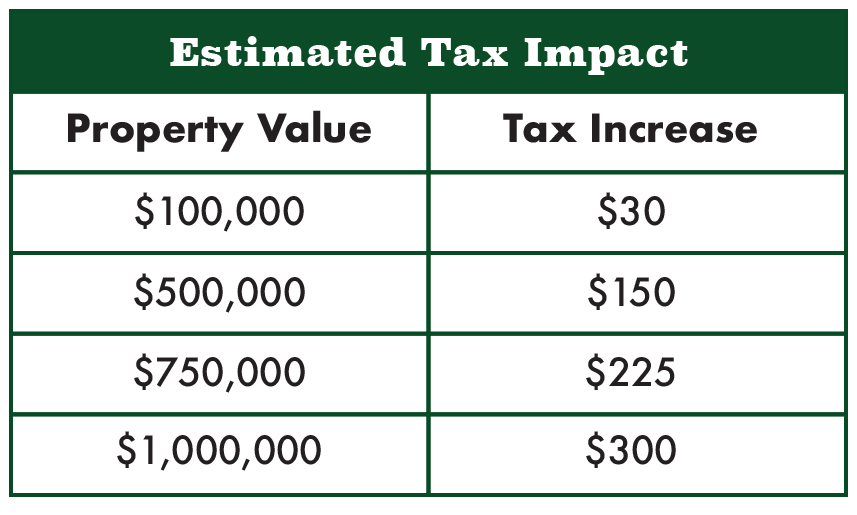

- A 0.1% tax increase equals about $30 per $100,000 of property value - or $300 per year for a $1 million home.

- An investment in parks is an investment in your home. Data shows that the addition of local parks can increase property values up to 10%.

___________________________________________________________________________________________________________________________________________

What Would This Referendum Fund?

A Limiting Rate Referendum would support every aspect of the Park District. The additional tax revenue would immediately help carry out projects identified in our 2023 Comprehensive Master Plan, which was shaped by extensive community feedback. A successful referendum would enable faster implementation of these projects, strengthen ongoing maintenance, and expand the Park District’s capacity to grow. This is our moment to go beyond maintenance — to take the places and programs we love to the next level as we meet the growing demands of our thriving community!

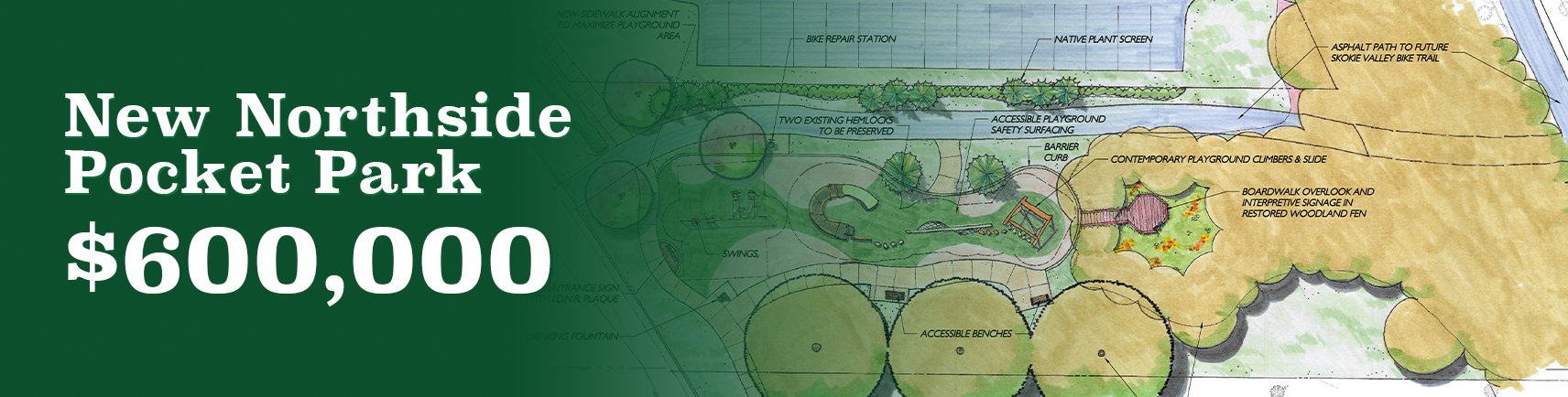

New Northside Pocket Park - $600,000

- A new park within walking distance for our northside residents

- Playground, bike repair station, benches, new plantings, woodland overlook

- Intergovernmental cooperation with Village of Northfield (Land Leased for $10)

- Connection to future Skokie Valley Trail.

Community Center Expansion - $2-3 Million

- Add indoor space for summer camps and growing youth program (appx 3,000 sq ft)

- Add community meeting/flex space

- Replace roof and address aging infrastructure

Willow Park Restrooms & Maintenance Facility Improvements - $2.5-3.5 Million

- Add outdoor restrooms for park users

- Add heat and water to maintenance facility

Strengthen Ongoing Maintenance and Increase Growth Capacity

Beyond capital projects, this is our moment to enhance maintenance to meet the growing demands of our thriving community. These are a few examples of the recurring maintenance costs in current market:

- Pickleball & Tennis Court Repairs - $70,000 (5-year life cycle)

- Outdoor Ice Rink - $5,000/year in water costs

- Baseball Field Renovations - $15,000/field

- Natural Area Maintenance - $30,000/year

- Clarkson Park Poured-In-Place Playground Surfacing - $400,000 (cost reflects full playground surface replacement)

A successful referendum would support the increasing costs of ongoing maintenance and also provide funding to expand programs, elevate our event experiences and acquire land for new parks.

How Would This Referendum Affect Your Property Taxes?

Small Increase, Big Impact!

A Limiting Rate Referendum asks for a permanent increase to the Park District tax rate. For this referendum, a 0.1% increase equates to approximately $30 per $100,000 of property value - or $300 per year for a $1 million home. If successful, this increase would still position Northfield in the lower half of surrounding park district tax rates. For more information on your property value and tax bills, visit the Cook County Assessor's Website.

Ballot Language Explained

As a voter, the language in the referendum may seem confusing. Below is a breakdown of the ballot question with an explanation for each section.

The Northfield Park District Referendum

Shall the limiting rate under the Property Tax Extension Limitation Law for the Northfield Park District, Cook County, Illinois, be increased by an additional amount equal to 0.100% above the limiting rate for levy year 2024 for park purposes and be equal to 0.300% of the equalized assessed value of the taxable property therein for levy year 2025?

Explanation: “We are asking voters to consider a 0.1% increase to the Park District’s tax rate, raising it from 0.2% to 0.3% in 2025 (taxes payable in 2026). This additional funding would support all areas of Park District operations and provide the resources needed for sustainable growth. It would help implement the projects outlined in the Comprehensive Master Plan, strengthen ongoing maintenance, and enhance the Park District’s overall capacity to serve the community.”

(1) The approximate amount of taxes extendable at the most recently extended limiting rate is $1,213,929, and the approximate amount of taxes extendable if the proposition is approved is $1,820,893.

Explanation: “The Park District is estimated to receive an additional $600,000 in annual tax revenue.”

(2) For the 2025 levy year the approximate amount of the additional tax extendable against property containing a single family residence and having a fair market value at the time of the referendum of $100,000 is estimated to be $30.

Explanation: “The increase to taxpayers would be approximately $30 per $100,000 of property value—for example, about $300 per year for a $1 million home.”

(3) If the proposition is approved, the aggregate extension for 2025 will be determined by the limiting rate set forth in the proposition, rather than the otherwise applicable limiting rate calculated under the provisions of the Property Tax Extension Limitation Law (commonly known as the Property Tax Cap Law).

Explanation: “The Property Tax Cap Law would not apply to the 2025 tax levy; instead, the voter-approved rate of 0.3% would be used to calculate property taxes for capped funds.”

Make Your Voting Plan!

The request period for mail-in ballots begins December 17th, and early voting starts March 2nd. To find out more about your voter registration status, polling places, and ways to vote, visit the Cook County Clerk's Website.

Who We Are

The mission of the Northfield Park District is to serve its residents by supervising the usage and maintenance of our park resources; offering facilities, programs, and activities designed to meet the leisure and recreational needs of the residents.

Willow Park

A premier sports complex set to undergo more improvements to the open spaces and natural areas in 2025 through an OSLAD Grant funded project.

Clarkson Park

A thriving destination thanks to the 2021 renovation that included a new playground, splash pad, pavilion and bandshell that hosts our summer concert series.

Community Center

Our main indoor recreation facility that is home to our vibrant youth programs. Major upgrades to the Fitness Center and Administrative areas were completed in 2016.

Fox Meadow

A park best known for active soccer fields while also providing the community with a playground and beautiful wetland area waiting to be explored.

- Each week, our parks and facilities welcome more than 2,000 people — from young athletes and their supporters to pickleball and tennis players, park walkers, dog walkers, and fitness members.

- We care for the parks that bring our community together—to play, walk, skate, gather, relax, and enjoy the outdoors.

- We have been a trusted steward of taxpayer dollars, accomplishing a great deal with limited resources. If you value what we have today, please know this is the extent of what we can continue to provide without additional support.

- We support children and families through affordable programs like summer camps, before/after school care, sports, and enrichment classes. This year, our camps served 798 children — from age three through 10th grade — an increase of 38% since 2021.

- Our before and after school programs now serve about 90 children each day. We host community events that celebrate togetherness and enrich our lives, such as Market & Music, 4th of July, Clarkson Cookout, Holiday Fest, Boo Bash, Eggstravaganza, etc.

- While we work closely with School District 29 and the Village of Northfield, we are a separate taxing body with our own funding and governance

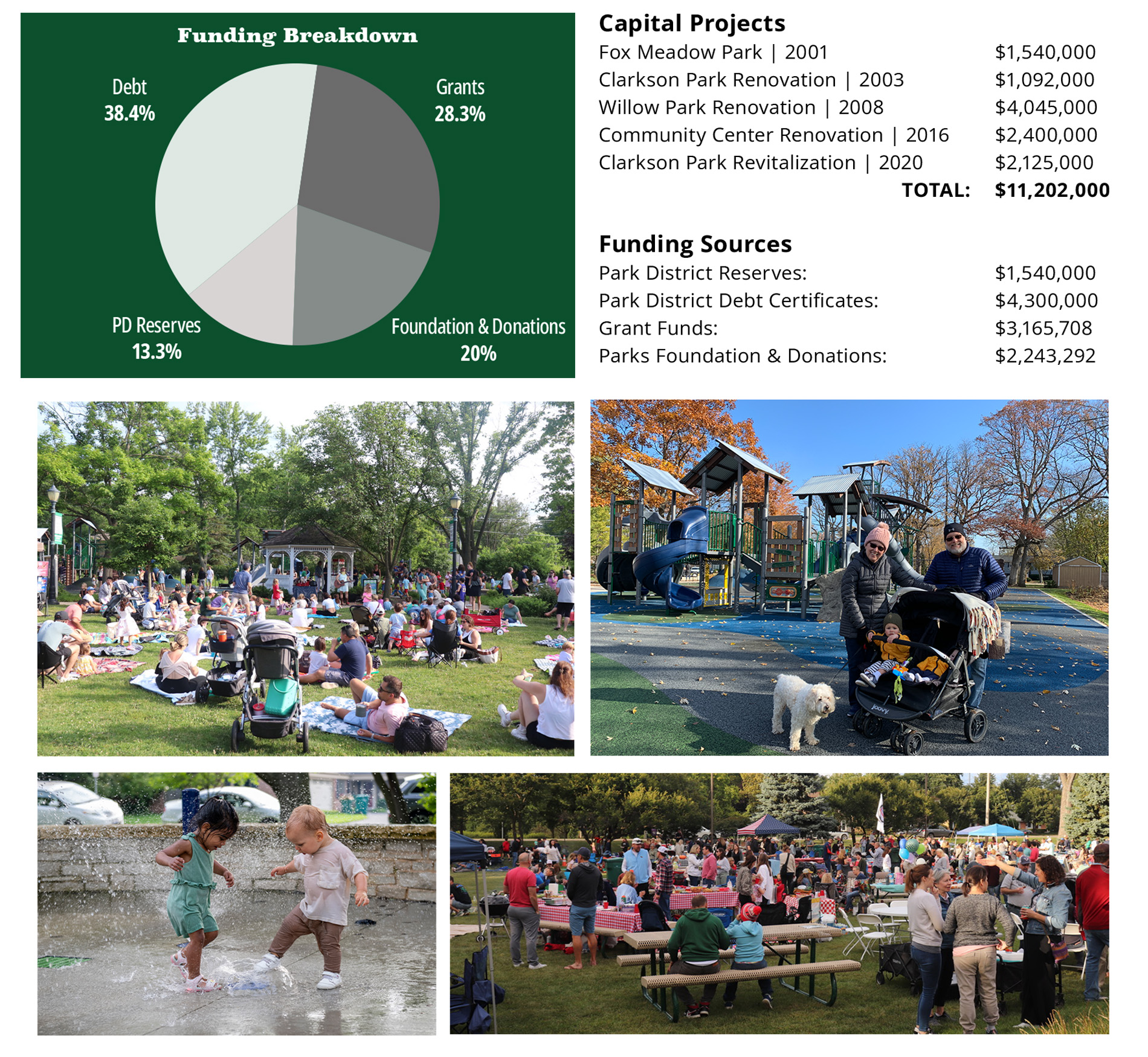

Past Achievements Since 2020

Trusted Steward of Taxpayer Dollars

Informative Referendum Documents

View Park District Referendum Presentation Slides

Questions or Comments About the Referendum?

The Park District would love your feedback about this referendum. Please use the form below to submit any questions or comments you may have. Form submissions may include your name and email or be made anonymously. If you wish to remain anonymous, simply leave the name and email fields empty.